How to Hire an Accountant for Your Small Business in 2024 (+Tips and Tools)

Finances are the lifeline of your small business. Ensure they’re in good hands (and in good health) by working with a professional accountant.

December 31, 2023

December 31, 2023 8 minute reading

8 minute reading

Some small business owners pride themselves on their multitasking abilities. But trying to handle finances yourself can quickly turn into an overwhelming headache.

Twenty percent of small businesses that don’t use accounting software struggle to continue operations after their first year. An accountant ensures your finances are in order, and can help you strategize for the future.

In this article, we’ll detail how to hire an accountant and decide between an in-house or outsourced accountant.

Hire a professional accountant on fiverr

What does an accountant do?

Accountants analyze and interpret your business’s finances. They help a small business understand its financial health and identify areas for improvement.

Accountants perform tasks like:

Preparing financial statements

Identifying tax deductions

Filing tax returns

Preparing balance sheets

Projecting future performance

Managing payroll

Note that accountants differ from bookkeepers. Bookkeepers manage day-to-day tasks, while an accounting professional offers financial planning.

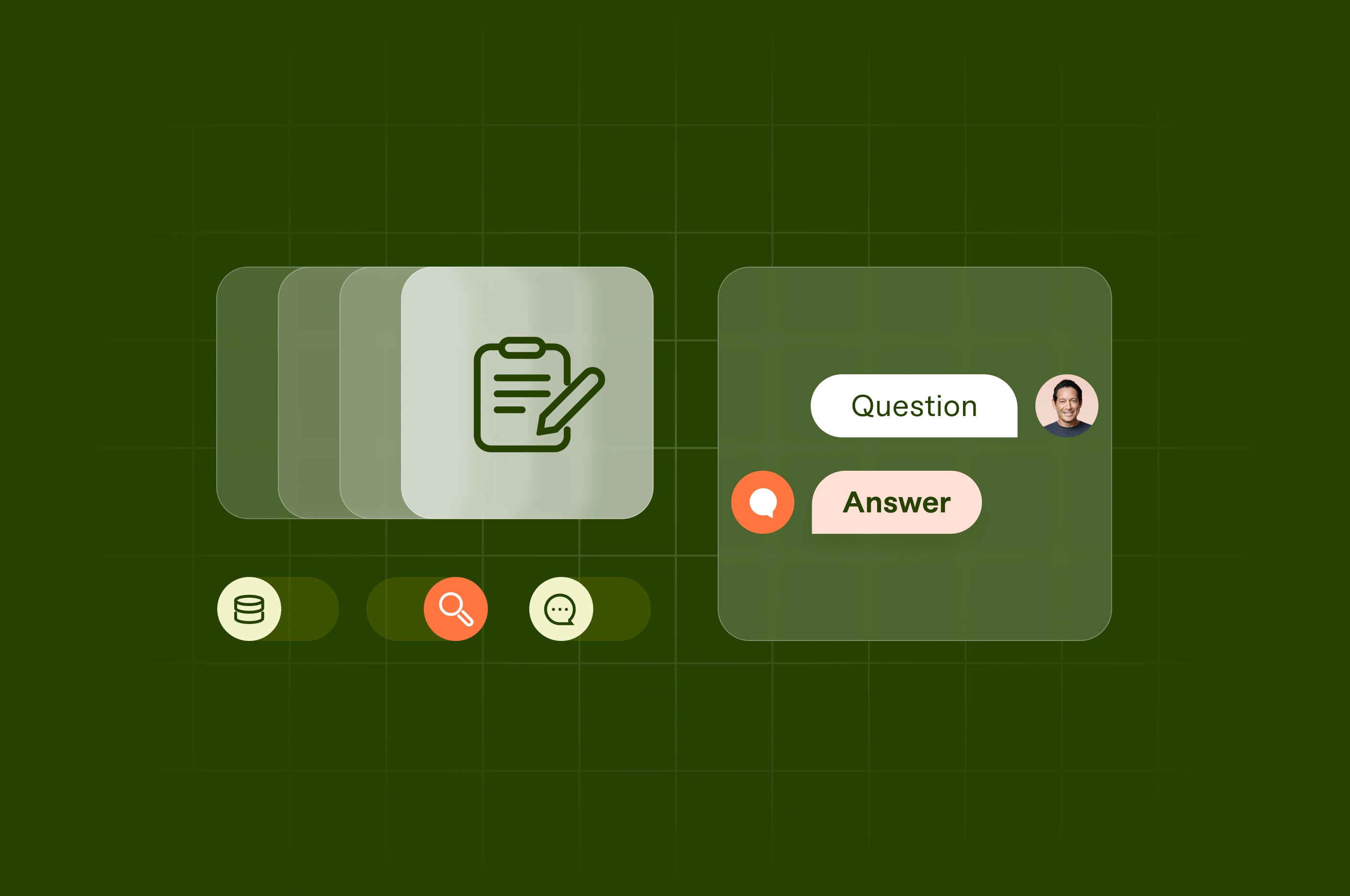

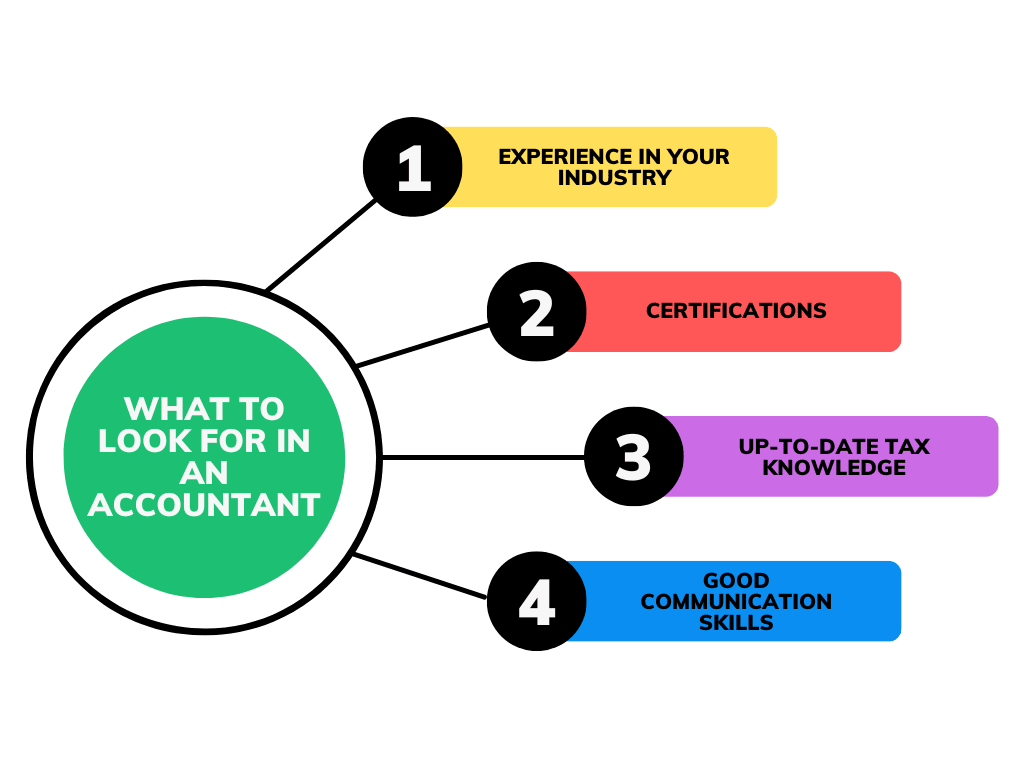

Accountants understand tax laws—whereas small business owners might not—so this is one of the main reasons business owners hire them. They can assess your tax situation, offer relevant tax advice, and help with your tax preparation. Beyond compliance, accountants provide valuable financial advice and guidance to businesses.

Accountants also assist with budgeting, forecasting, and strategic planning. They ensure businesses have the financial resources needed to achieve their goals. If you’re a small business owner wanting to scale and grow, then an accountant can help you reach long-term financial stability.

Chart displaying survey results regarding what services accountants help business owners with.

Why hire an accountant for your small business?

As a small business owner, you’re used to being a Jack- or Jill-of-all-trades. Even if you can do it all, hiring an accountant frees you to focus on running your business.

Even if you think you can handle your finances on your own, accountants can save you money by identifying tax deductions and credits you may be unaware of. Plus, they can negotiate with vendors on your behalf.

Twenty-eight percent of small businesses have been audited or received a notice from the IRS. And the IRS has plans to increase audits for small business owners. If you’re not confident in your ability to prepare your financial documents, invest in a good accountant.

What to look for when hiring an accountant?

Before writing a job description to hire an account, identify what to look for.

Here are key factors to consider when making your decision:

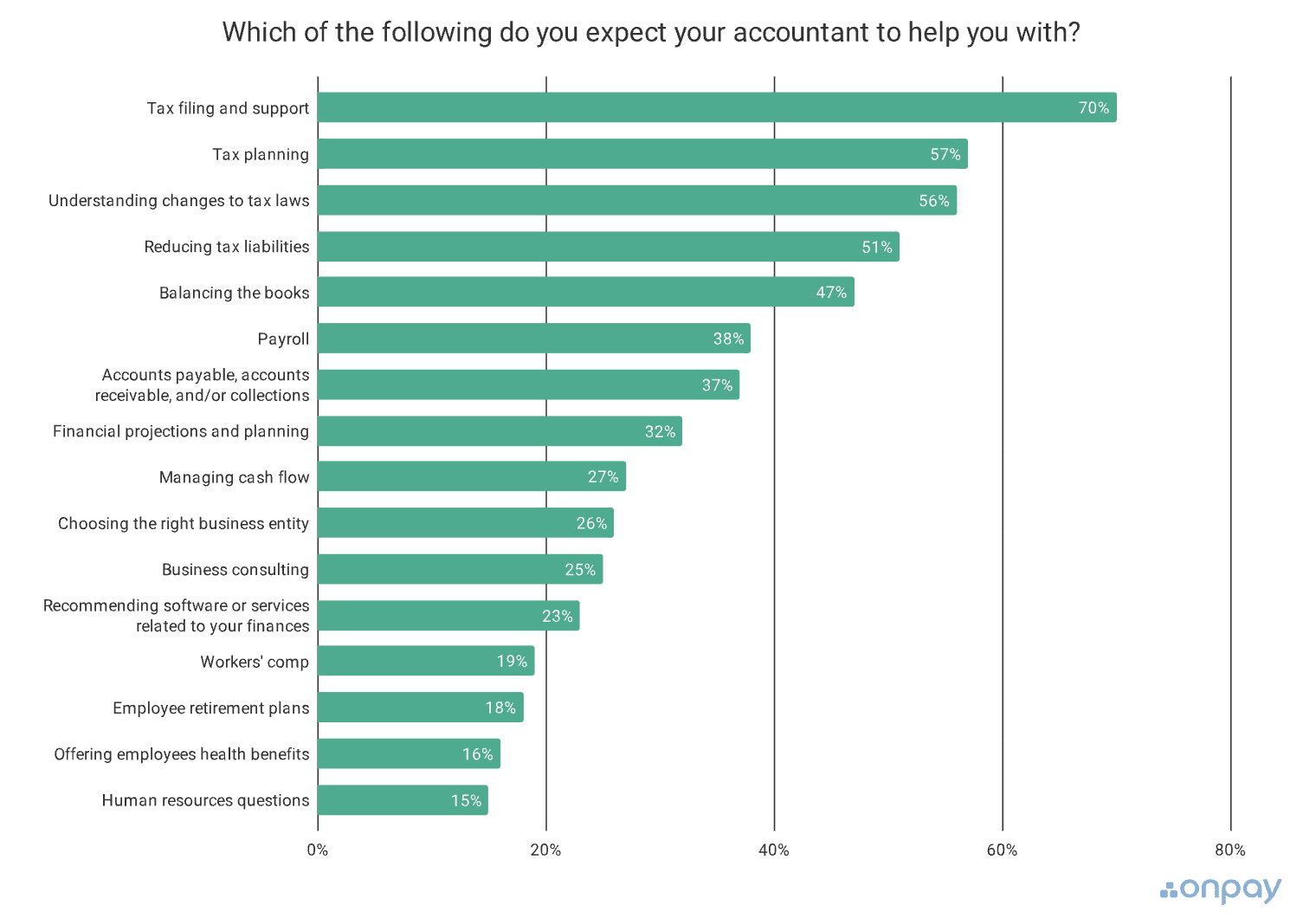

Experience in your industry. The more niche the better. An account familiar with your line of work should understand the unique challenges and opportunities your business faces.

Certifications. Look for an accountant with professional certifications, such as the Certified Public Accountant (CPA) or Certified Management Accountant (CMA) designation. These certifications show the accountant meets rigorous standards of education and experience.

Up-to-date tax knowledge. Tax laws constantly change, so find an accountant who stays updated on the latest tax regulations in your area. This prevents costly penalties when tax season rolls around.

Good communication skills. Look for someone who can clearly explain complex financial concepts so you can easily understand.

References. Ask for references and referrals from other small business owners who have worked with the accountant. This can provide valuable insights into the accountant's work ethic, professionalism, and ability to deliver results.

“I always ask candidates about their experience with the financial reporting and tax compliance process in a company,” says Gauri Manglik, CEO and cofounder of Instrumentl, an all-in-one grants platform. “I want to know if they have experience with the kind of work that we do, so I ask them about their experience with using software like Xero or QuickBooks Online, for example. I also want to know what questions they'd ask a client whose records were in disarray and needed help getting them in order—and how they would approach that situation.”

Chart detailing the qualities to look for in an accountant.

How to hire an accountant in 5 steps

In five simple steps, you can hire an accountant and ensure the health of your small business’s finances.

Here’s how.

1. Define your business needs

Accountants can assist with various tasks, so identify what you need help with. This will also determine your budget for the associated responsibilities.

Ask yourself the right questions to learn your needs, such as:

What are your financial goals?

What are your biggest financial challenges?

What kind of financial reports do you need?

What kind of record-keeping services are you looking for?

What hourly rate can you afford?

Depending on your answers, you may need a full-time, in-house employee. Or, maybe a part-time accountant or freelancer accountant is the right accountant for you.

For example, if you need assistance with tax preparation and financial reports, a freelance accountant may be the right fit. But if you need ongoing help with payroll, financial forecasting, and other record-keeping tasks, a full-time or part-time accountant may be the best fit.

2. Write a job description

To attract the best talent, prepare a quality job posting. Outline the specific accounting tasks you expect the accountant to perform. It should also include information about the accounting experience you’re looking for.

Include this in your job description:

Responsibilities of the role (tax filing, tax planning, bookkeeping)

Compensation

Job title

Necessary qualifications

You can also work with a freelancer to find superstar talent with a professional job description. Once you’re satisfied with all the details in your description, publish it to popular job boards and marketplaces like Fiverr.

3. Prepare interview questions

Don’t go into an interview blindly—just as candidates need to prepare, so should you. Write a list of interview questions to gather all the information needed to hire the right small business accountant.

Tell the candidates information about you and your business plan as well. Let them know what accounting software and accounting systems you currently use to see if they’re familiar with them or willing to learn.

Here are example interview questions:

How do you stay organized when managing multiple projects?

What experience do you have working with budgets?

Describe your experience with financial analysis and business taxes

What challenges have you faced in previous accounting roles?

How would you go about auditing financial records?

Figure out how candidates’ communication skills match with yours during this portion of the hiring process.

“I’m very conversational during the interview, staying quiet and allowing pauses,” says Ronald Osborne, founder of Ronald Osborne Business Consultancy. “Confident accountants who know their stuff are happy to fill the gaps with additional knowledge. They’re focused on the big picture, but have the smaller details down pat.”

4. Assess candidate’s performance

After talking with your top candidates, do your due diligence and evaluate those conversations alongside their applications. Your interviews will be vital because communication skills and a good relationship matter more than certificates and years of experience.

“Look beyond technical skills,” says Sudhir Khatwani, director of The Money Mongers, an online cryptocurrency community. “Consider how well the accountant can communicate financial information to non-financial team members and their ability to think strategically about the business's financial health.”

Hire a professional accountant you think fits with your own business. You should trust this person, since they’ll analyze sensitive data, such as your cash flow, bank account, and credit card statements.

5. Onboard your new accountant

After deciding, onboard the best accountant for your small business. Sign a contract that outlines the accountant's duties and responsibilities, as well as their fees and billing structure.

To maintain a good relationship with your new financial advisor, align on relevant goals and expectations, and check in with them frequently.

“We have a structured onboarding process that includes familiarization with our financial systems and processes,” says Khatwani. “Regular check-ins in the first few months help ensure alignment with our financial goals.”

Some small businesses use artificial intelligence to help with onboarding processes.

In-house vs outsourced accountants

Deciding between an in-house or outsourced accountant is an important decision. Both out-of-house and full-time employees come with pros and cons.

In-house accountants

An in-house accountant only works for you and your business. Some of the associated pros to this are:

Wide range of customized accounting services

Easier access and communication

Greater trust with confidential financial information

Some cons of working with an in-house accountant are:

More expensive than an outsourced accountant

Takes more time to train and onboard

May take too many resources and time from other areas of the small business

If you’re a small business looking for a long-standing relationship with an accountant and various accounting services—then an in-house accountant may be right for you.

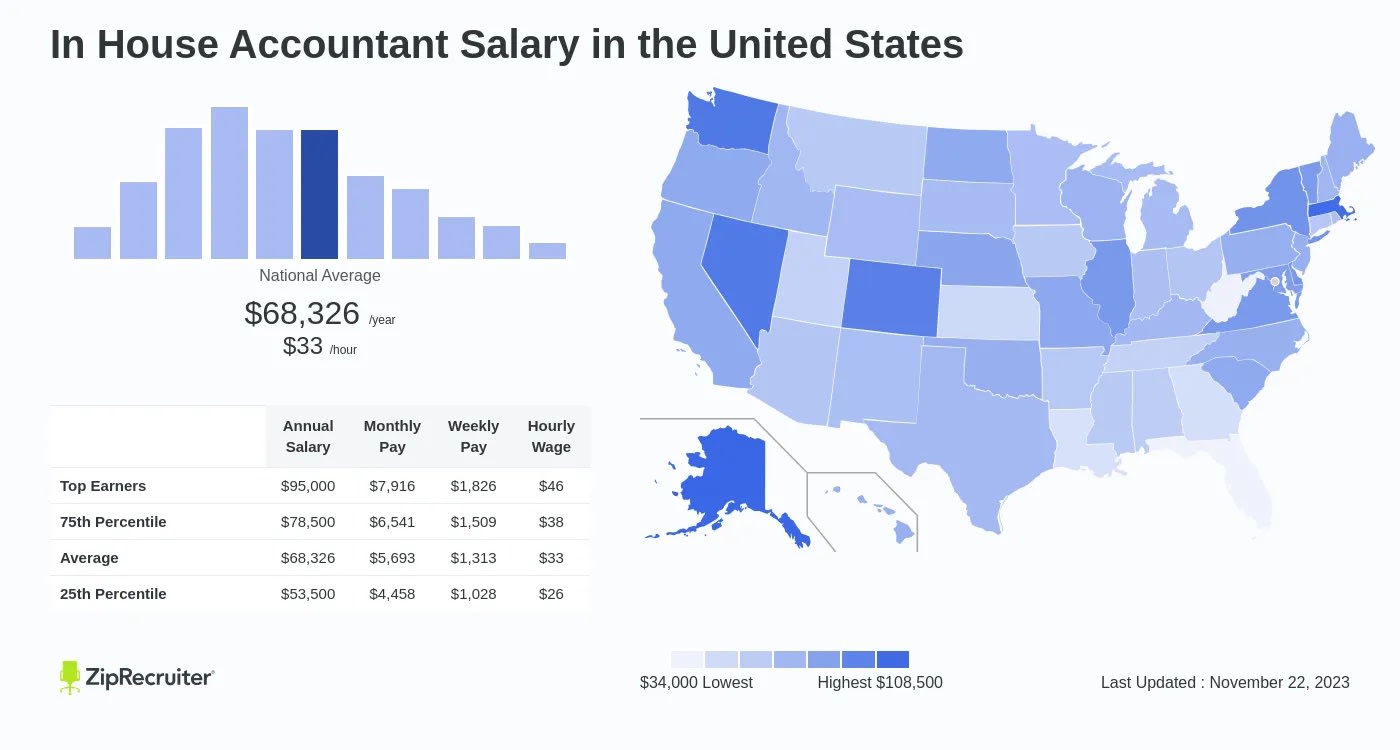

Chart detailing the average in-house accountant salary in the United States.

Outsourced accountants

Many small businesses prefer to outsource their accounting tasks because it’s less costly and more flexible. Accounting can be one of the roles your virtual assistant does, too. You can work with an outsourced accounting firm or with freelance accountants.

Some of the associated pros for outsourced accounts are:

Increased flexibility of specialized services

Opportunity to scale up or down accounting needs

More cost-effective than a full-time employee

Some cons of working with outsourced accountants are:

Potential time zone issues

Lack of immediate communication

Risk of security issues

If you’re a startup or small business that only needs a few accounting services and that doesn’t have the finances to support a full-time employee, then an outsourced accounting firm or freelancer may be best for you.

How to find a freelance accountant on Fiverr in 5 steps

Many small business owners turn to Fiverr to delegate the time-consuming tasks associated with running a small business. Fiverr simplifies finding a freelancer to help with accounting and bookkeeping.

Here’s how.

1. Sign up for Fiverr

If you don’t already have an account with Fiverr, start by signing up here.

Image of the page where you can sign up for Fiverr.

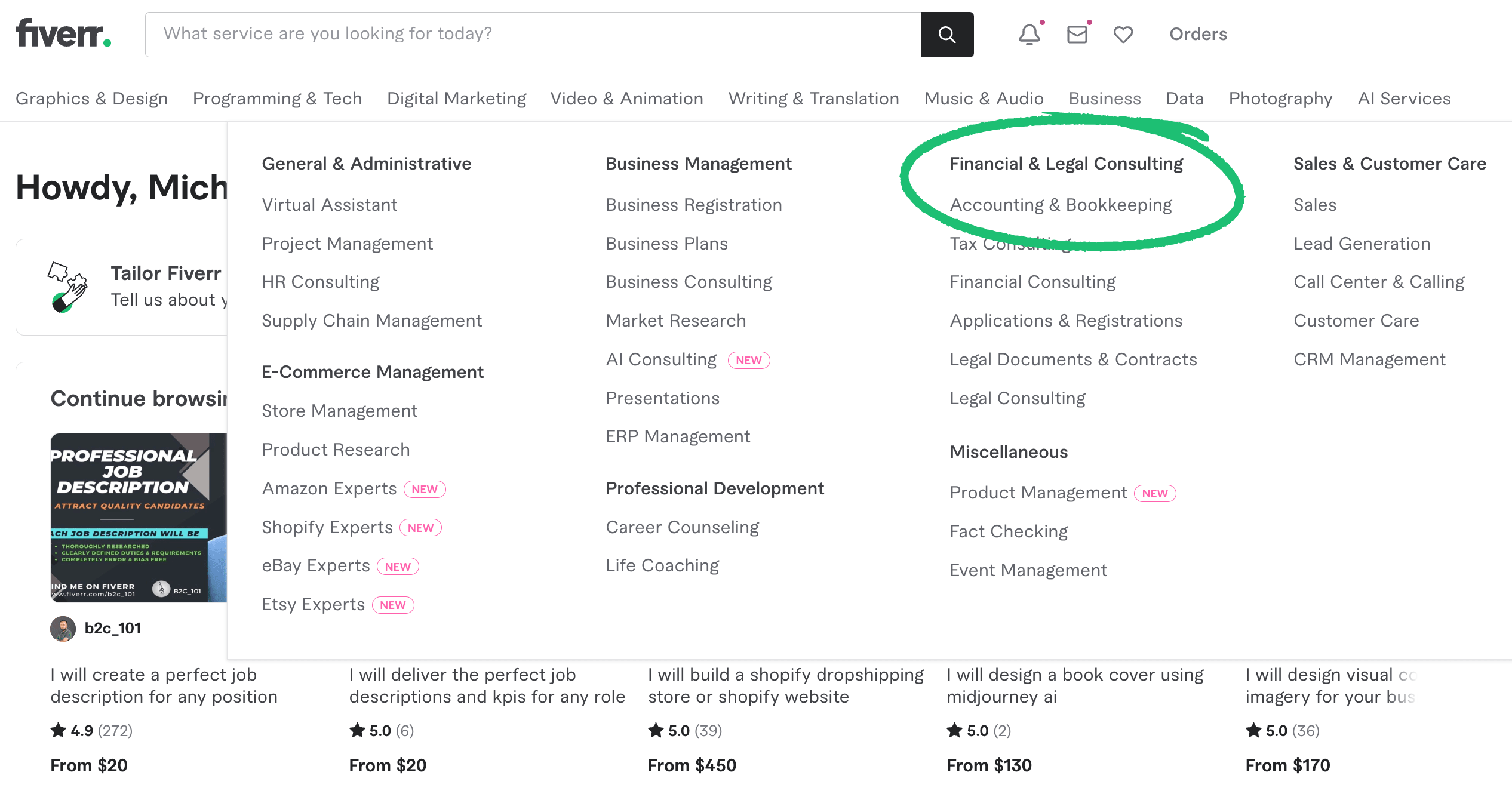

2. Navigate to the “Business” category

Fiverr offers a variety of freelancer services, but to find an accountant you need to click on the “Business” category. In that drop-down, you’ll find “Accounting and Bookkeeping” under “Financial and Legal Consulting.”

Image of options under Fiverr’s “Business” category

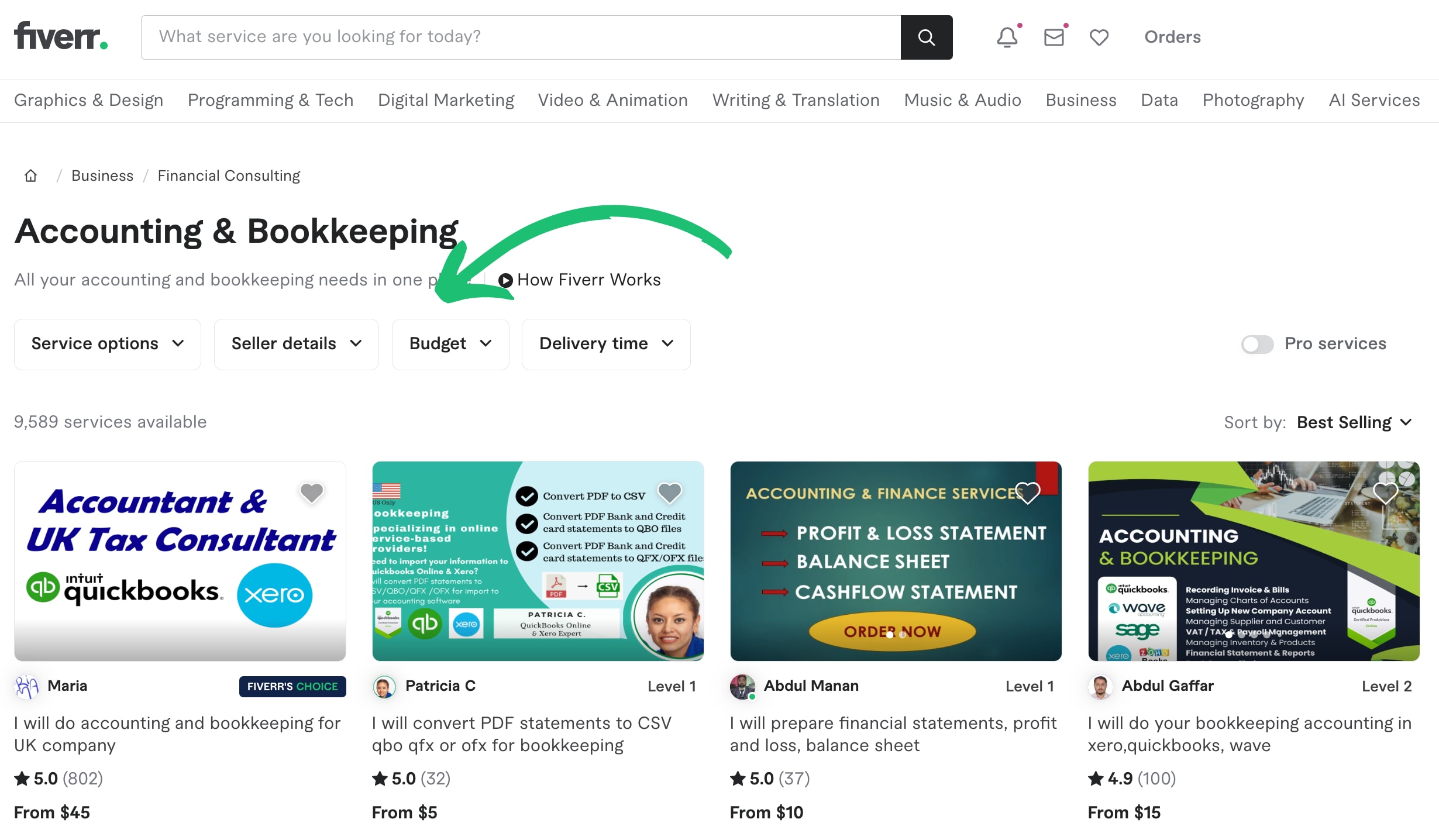

3. Filter your search

You can filter your search several ways.

Here are some examples:

Service options. Filter by industry, target country, software, and language.

Seller details. Filter by seller level, language, and location.

Budget. Filter by value, mid-range, high-range, or custom.

Delivery time. Filter by 24 hours, up to three days, up to seven days, or anytime.

Image of the filter options on Fiverr.

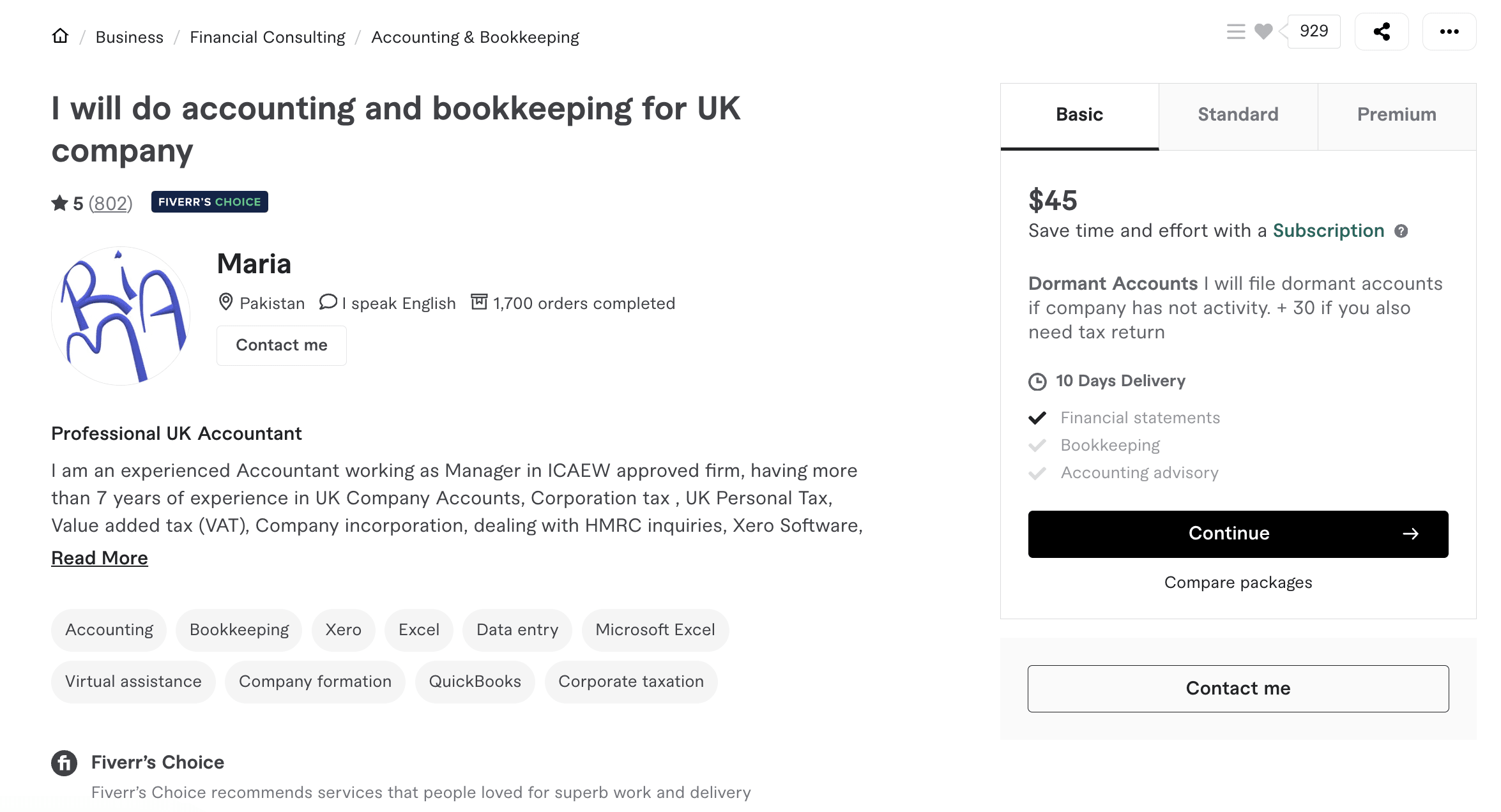

4. Explore potential accountants

Browse a few accountants that catch your eye.

Take a look at their:

Payment packages

Reviews

Portfolio

FAQs

Description

Example of an accountant's seller page on Fiverr.

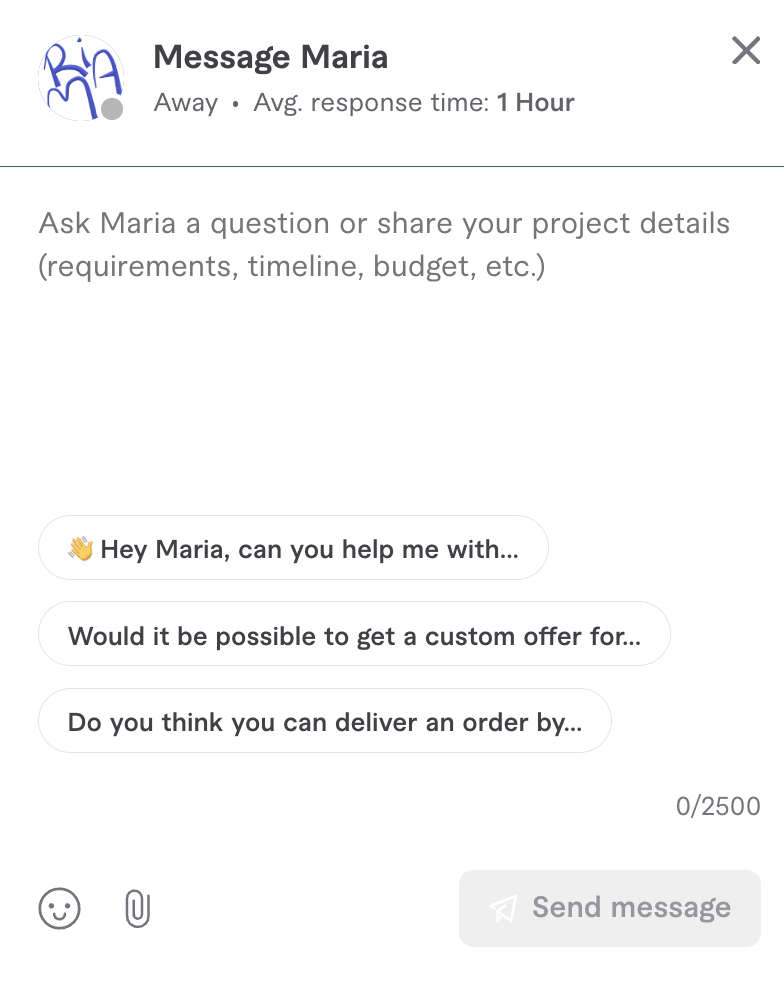

5. Contact the accountant you want to work with

You can hire your accountant immediately, or contact them to establish a relationship and confirm any necessary details. Share with them your requirements, timeline, and budget to see if it’s a good fit.

Image of the contact option for a Fiverr accountant.

Ready to get started?

Join Fiverr to access a growing marketplace of freelancers who can help you with a variety of tasks associated with running your small business. From accounting to tax consulting to startup consulting, there’s a freelancer equipped to help you.